Crypto mining is legal in India, but the rules around it are not very clear. There is no direct law that bans or licenses the activity, so people can mine coins like Bitcoin or Ethereum without official permission.

Many ask, is Bitcoin mining legal in India in 2026? The answer is yes, but the system treats mining more like a business process than a financial service.

The bigger challenge comes from crypto taxation rules. Earnings are taxed strictly, and costs like power or hardware are not given relief.

So, the crypto mining legal status in India is open but uncertain. Miners must think about electricity, cooling, and policy changes before entering the space.

What Is Crypto Mining and How Does It Work?

Crypto mining is the process through which new, booming cryptocurrency coins are created and blockchain transactions are validated.

It ensures the integrity and security of decentralized networks like Bitcoin and Ethereum.

Basics of Crypto Mining

At its core, crypto mining uses a consensus mechanism called Proof of Work (PoW). In PoW systems:

- Miners compete to solve complex mathematical problems known as cryptographic hashes.

- The first to solve it verifies a transaction block, which is then added to the blockchain.

- In return, miners receive newly minted coins and transaction fees.

This not only issues new currency but also protects the blockchain from double-spending or cryptocurrency scams that threaten trust in the network or fraudulent transactions.

Role of Miners

Miners play an important role in running decentralized networks like Bitcoin. While people often ask, Is Bitcoin mining legal in India, their work of verifying transactions helps keep the blockchain system honest and secure.

- Validate transactions

- Add new blocks to the blockchain

- Enhance the security and trust in the crypto network

Mining Methods

There are different ways people mine cryptocurrencies legally in India, each needing different tools and setups. Your choice affects the cost, ease, and results of your mining efforts.

1. ASIC Mining: Involves high-performance, single-purpose hardware. Efficient for Bitcoin, but expensive.

2. GPU Mining: Uses graphics cards. More versatile and better suited for altcoins like Ethereum Classic, Ravencoin, and Litecoin.

3. Cloud Mining: Enables users to rent mining equipment online. Ideal for beginners, it requires no technical setup or hardware investment.

These different methods allow individuals and businesses alike to participate in crypto mining at various scales and budgets.

What Does The Law Say About Crypto Mining In India?

The legal status of crypto mining is one of the most commonly asked questions in the Indian crypto space. While no law clearly allows or bans it, there are important things to know.

Understanding this grey zone is key before investing your time or money:

1. Legal Status: The Straight Answer

As of 2026, crypto mining is legal in India. There are no prohibitions against mining activities. However:

- Cryptocurrencies are not considered legal tender.

- The Indian government has not issued specific laws or licenses concerning mining.

Mining is considered a technical process, not a financial service, and is permitted as long as it adheres to general business and tax laws.

2. Understanding the “Grey Area”

Crypto mining operates in a regulatory vacuum. The Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), and the Ministry of Finance oversee various aspects of cryptocurrency, but not mining directly.

This absence of direct legislation makes mining legal but unregulated. There are no defined licensing protocols or compliance standards for crypto miners.

Legal Milestones

1. 2018: RBI bans banks from servicing crypto businesses.

2. 2020: The Supreme Court overturns this ban, deeming it unconstitutional.

3. 2022–2026: Multiple discussions around the proposed Cryptocurrency and Regulation of Official Digital Currency Bill. While not passed, it indicates regulatory movement.

Source: PRS Research Report

For now, mining in India continues without restrictions, but policy changes remain possible.

Do You Need Permission or Licenses to Mine Crypto in India?

This is a concern for many beginners and potential miners. Unlike financial services, crypto mining is not officially licensed yet in India. Still, there are certain rules you should be aware of before you begin.

Regulatory Overview

Currently, individuals or businesses do not need any license or government approval to mine cryptocurrency in India. According to prevailing law:

- Crypto mining is not categorized as a financial service.

- It does not fall under money transmission or foreign exchange services.

- Miners are not required to register with any central agency.

Anyone with the appropriate hardware, software, and skills can start mining legally.

Global Comparison

Mining rules differ from country to country. Some places require licenses, while others allow mining more freely, like India for now.

In contrast:

- The United States often requires money transmitter licenses at the state level.

- Canada mandates mining registration under financial transaction regulations in some provinces.

India’s laissez-faire approach offers operational ease, though this could evolve with upcoming regulations.

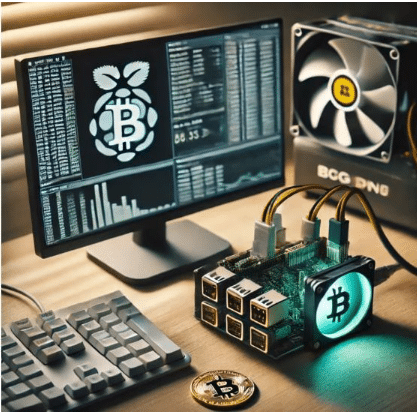

How To Start Crypto Mining in India (Step-by-Step)

Crypto mining in India follows the same foundational steps as elsewhere, but with special considerations for electricity costs and hardware import rules.

Step 1: Select a Cryptocurrency to Mine

Choose between Bitcoin, Ethereum Classic, Litecoin, or other altcoins depending on profitability and hardware requirements.

Step 2: Set Up Your Mining Hardware

- ASICs: Best for Bitcoin, but require high capital and power.

- GPUs: Suitable for altcoins and more affordable.

- Cloud Mining: No equipment needed. Rent hash power online.

Step 3: Install Mining Software

Examples include CGMiner, EasyMiner, or proprietary software from cloud mining platforms.

Step 4: Join a Mining Pool

Solo mining is difficult. Pools increase block-finding probability and offer steady income.

Step 5: Start Mining and Track Rewards

Use dashboards or mobile apps to monitor hash rates, power consumption, and coin earnings.

Step 6: Manage Cooling and Electricity

Indian climates demand reliable cooling systems. Factor in monthly power bills to estimate net returns.

Starting crypto mining is accessible, but profitability hinges on careful setup and cost management.

What Are the Challenges of Crypto Mining in India?

Despite legality, several operational and strategic challenges complicate crypto mining in India.

Operational and Economic Barriers

Before jumping into crypto mining, it’s important to consider the practical hurdles that can impact profitability.

1. High Electricity Tariffs

Most states charge elevated commercial rates, reducing margins.

2. Cooling Requirements

India’s tropical climate forces miners to invest in industrial cooling units, especially in cities like Delhi and Mumbai.

3. High Import Costs

Mining rigs and ASICs are mostly imported. Duties, GST, and shipping push prices up by 20–30%.

4. Lack of Local Mining Infrastructure

Few Indian mining pools or data centers exist, limiting domestic collaboration and increasing latency.

Legal and Investment Uncertainty

Beyond technical challenges, the lack of clear regulations adds a layer of risk for miners and investors alike.

1. No Clear Mining Framework

The absence of specific laws or licenses creates investor hesitation.

2. Volatile Policy Environment

Discussions around banning private cryptocurrencies (like in the Crypto Bill) keep the market on edge.

3. Reluctance from Institutional Investors

Due to tax burdens and ambiguous laws, VC and startup interest in mining remains limited.

These challenges mean that while individuals can mine, scaling operations into full-fledged mining farms remains rare.

Is Crypto Mining Profitable in India in 2026?

Crypto mining is legal in India, but the question is about its profitability, which depends on multiple dynamic factors. While still viable in 2026, it requires strategic planning and smart resource management.

Crypto Mining Key Profitability Factors

1. Electricity Costs

India’s commercial electricity rates are relatively high. States like Gujarat and Tamil Nadu offer lower tariffs, especially for solar or wind-powered setups.

2. Hardware Investment

- ASIC miners cost ₹2–5 lakhs and have limited resale value.

- GPU rigs offer flexibility but lower performance.

- Import duties and GST significantly raise prices.

3. Mining Pool Selection

Joining efficient, low-fee mining pools maximizes reward share and smoothens income flow.

3. Market Volatility

Crypto prices fluctuate wildly. Profits today could turn into losses tomorrow, especially if coins are held before selling.

4. Choice of Coin

- Bitcoin: High security, low short-term yield

- Altcoins: Lower entry cost, but riskier

New Crypto Trends in 2026

- Cloud Mining: Popular among small investors, but often less profitable after fees.

- Green Mining: Growing focus on solar and wind-powered rigs for sustainability and long-term cost reduction.

Bottom Line: Mining can be profitable, but only with controlled costs and updated market insights. Success depends on location, hardware, electricity pricing, and coin strategy.

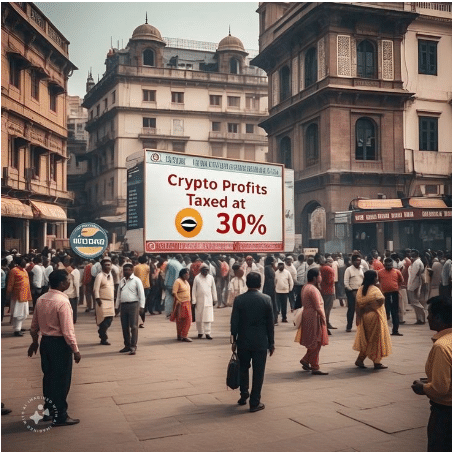

How Is Crypto Mining Taxed in India?

Mining earnings are taxed at a flat 30% as income in India, with no cost deductions allowed for expenses like electricity or hardware. When the mined crypto is later sold, it’s taxed again as capital gains, also at 30%. This dual taxation structure makes the overall tax burden heavier compared to many other countries.

Taxation Structure

In India, mined crypto is treated like income and taxed at a flat rate. This makes tax planning an important part of the mining process.

1. Income Tax on Mined Coins

The fair market value (FMV) of the crypto at the time it is mined is treated as income. This income is taxed at a flat 30% rate under Section 115BBH of the Income Tax Act.

No deduction is allowed for:

- Hardware costs

- Electricity

- Maintenance or depreciation

2. Capital Gains Tax on Sale of Coins

If the mined coins are later sold or swapped:

- Capital gains = Sale price – FMV at the time of mining

- This gain is also taxed at 30%

3. 1% TDS (Tax Deducted at Source)

- Applied on crypto transfers exceeding ₹50,000 per year (₹10,000 in some cases)

- Exchanges usually deduct this automatically

Do You Know?

Crypto is not accepted as legal tender in India, yet debates continue around whether is crypto real money in practice.

Additional Tax Considerations

Beyond income tax, additional charges like GST on mining hardware and reverse charge GST on cloud services can significantly impact your overall mining profitability and must be accurately accounted for.

GST on Mining Hardware

ASICs and GPUs incur 18–28% GST plus import duties.

- Cloud Mining Taxation

Earnings from cloud mining are also taxed under the same provisions. Cloud service payments to foreign companies may incur GST under the reverse charge mechanism.

Example

If you mine 0.05 BTC worth ₹1,50,000:

- ₹45,000 is immediately due as income tax

- Later, if sold at ₹2,00,000, you pay 30% on ₹50,000 capital gain = ₹15,000

- Total tax burden = ₹60,000 (plus any TDS)

Environmental Concerns Around Mining

The power used by mining rigs adds stress to already stretched grids. In a country like India, this can affect both bills and the planet. Sustainable methods are slowly becoming more important.

Sustainability Issues

Mining uses a lot of electricity, which creates pressure on power systems. In India, this can lead to both financial and environmental problems.

- High Power Consumption: Mining rigs operate 24/7 and require continuous cooling, increasing energy use.

- Coal Dependency: India still relies heavily on coal-fired power plants, adding to carbon emissions.

- Heat Emissions: Mining generates significant heat, further straining infrastructure in hot climates.

Green Solutions on the Rise

Many miners are turning to solar and wind energy. This helps reduce costs and the impact on the environment.

- Solar and Wind Energy: States like Gujarat, Rajasthan, and Tamil Nadu are leveraging renewable sources.

- Green Mining Farms: A few startups are establishing low-impact operations using renewables.

- Energy-Efficient Hardware: Modern ASICs and cooling systems aim to reduce footprint.

Eco-conscious mining is becoming essential, especially as global climate policy tightens. Sustainable practices may become mandatory in future regulatory frameworks.

Is Bitcoin Mining Legal in India?

Bitcoin mining is governed by the same rules as other cryptocurrencies. Bitcoin mining is legal in India, although subject to the same ambiguous regulatory environment.

Same Legal Rules Apply

Bitcoin, as the most established cryptocurrency, is not recognized as legal tender but can be mined, held, or traded freely. Income and profits are taxable under Indian law.

Hardware Considerations

To start mining, you need powerful machines like GPUs or ASICs. These devices are expensive and need good power and cooling support.

Bitcoin mining requires ASIC hardware, which is:

- Expensive and high-powered

- Demands significant cooling and electricity

- Subject to import duties and GST

Due to the increasing difficulty level and energy consumption, individual miners often pool resources in mining pools to improve success rates.

Best States for Crypto Mining in India

Some states offer cheaper power or better weather for cooling systems. Others can be too expensive to mine. Choosing the right place makes a big difference in profit.

Power-Friendly Mining Zones

- Gujarat: Known for its robust solar energy programs and industrial-friendly policies.

- Karnataka: Tech ecosystem with relatively low commercial power tariffs and reliable infrastructure.

- Tamil Nadu: Actively investing in wind energy and large-scale data infrastructure.

- Rajasthan: High solar potential and proactive in renewable energy adoption.

These states offer the best balance of power, reliability, climate suitability, and infrastructure for crypto mining. They also present future opportunities for green mining hubs.

What Does the Future of Crypto Mining Look Like in India?

Things may change soon with new laws and technological developments. More people are turning to altcoins or mobile-based mining, and the future of digital currency in India will largely depend on how the government responds to these trends.

Anticipated Developments

India is slowly moving towards clear rules for digital activities. Crypto mining could soon see changes in how it is regulated.

- Regulatory Frameworks

The government is preparing consultation papers and legislative drafts, which may:- Define mining guidelines

- Introduce licenses and KYC compliance

- Create monitoring mechanisms for tax and sustainability

- Formal Licensing

Similar to the U.S. or EU, miners may eventually require registration and certification. - Web3 and Blockchain Adoption

Government projects in Telangana and Maharashtra show increasing openness to decentralized tech, hinting at broader acceptance. - Rise of Altcoins

Coins like Chia and Ravencoin, which consume less energy, are gaining traction among Indian miners seeking profitability and sustainability. - Tax Reforms

Future revisions to the VDA tax regime may:- Allow cost deductions

- Introduce capital gain indexing

- Clarify tax on staking, cloud mining, and mining pools

India’s mining future will likely depend on a balance of innovation, regulation, and environmental responsibility. Miners must stay informed and adaptive.

Crypto Reads For Miners:

Conclusion: In 2026, Crypto Mining Or bitcoin Mining Is Legal In India

Crypto mining is legal in India but remains unregulated and heavily taxed. Income is taxed at a flat 30% with no deductions, and a 1% TDS applies to large transfers. Miners need to plan carefully to stay compliant and profitable.

While no licenses or permissions are currently required, miners should be cautious of legal and policy shifts. The industry operates in a grey zone, and formal regulation may soon arrive.

To stay compliant and profitable, crypto miners in India must keep a close watch on tax updates, manage electricity and hardware costs, and stay informed about proposed regulations. Staying proactive is key in this evolving landscape.

FAQs

Crypto mining is currently permitted in India, although it operates without dedicated regulations or formal oversight.

At present, mining activities do not require any specific license or government approval.

Mined cryptocurrency is taxed as income at a flat 30%, and a 1% TDS applies on large transactions.

Bitcoin mining is treated like any other cryptocurrency activity and is allowed under the current legal framework.

Home mining is possible, but individuals should carefully consider factors like electricity rates, hardware costs, and cooling requirements.

Cloud mining is legally allowed and has become a popular entry point for beginners due to its low setup requirements.

There are no current signs of a ban, but future regulations could impose tighter controls or new compliance requirements.