Cryptocurrency fraud might seem like a small slice of the scam world, just 10% of reports to the FBI, but it’s causing nearly half of all financial losses. Pretty wild, right?

The crypto space has grown into a multi-trillion-dollar market, and people everywhere are jumping in, chasing financial freedom or just trying to ride the next big wave.

But with all that excitement comes risk. Scammers are everywhere, using crypto’s decentralized setup to pull off high-tech heists and steal billions from unsuspecting folks.

This article is here to help. We’ll break down the most common crypto scams out there and give you real, practical tips to keep your money safe.

Types Of Crypto Scams: In A Nutshell

- Phishing scams steal your wallet keys through fake emails or sites.

- Rug pulls happen when developers abandon projects after funding.

- Ponzi schemes pay old investors using money from new investors.

- Fake giveaways use celebrity impersonation to trick people.

- Malware can drain your wallet when connecting to unsafe sites.

- Cloud mining scams promise earnings but deliver nothing.

- Always verify URLs, use strong security, and research before investing.

- If you are scammed, report the incident quickly, inform your bank, and seek legal advice.

- Crypto’s anonymous nature makes it prone to scams and fraud.

Detailed Breakdown: Common Types Of Crypto Scams

Understanding the most common crypto scams is key to staying safe. Here’s a quick breakdown of the most common crypto scams to watch for.

1. Phishing Scams

Phishing represents the most common entry point for cryptocurrency theft, where scammers craft convincing emails, texts, or websites that mimic legitimate cryptocurrency services.

These attacks typically direct victims to fake login pages that harvest wallet credentials or private keys.

Scammers craft these messages to emulate the style and tone of legitimate organizations, often creating a sense of urgency or fear to manipulate victims into taking action.

For example, fake Coinbase emails might warn of “account suspension” requiring immediate verification.

Red Flags: Urgent language, misspelled URLs (like C0inbase.com instead of Coinbase.com), and unsolicited security alerts.

Always navigate directly to official websites rather than clicking email links.

2. Rug Pulls

A hard rug pull is when a developer has no intention of ever completing a project and intends to scam investors from the start.

In contrast, soft rug pulls involve legitimate-seeming projects that developers eventually abandon.

Rugpull losses have skyrocketed in 2025, with a single DeFi scam accounting for nearly $6 billion of the total losses.

The notorious Squid Game token exemplifies this scam type, raising $3.3 million before developers drained liquidity pools and vanished.

Red Flags: Anonymous development teams, lack of code audits, extremely high promised returns, and restrictions on selling tokens.

Research the backgrounds and project roadmaps of the research team thoroughly before investing.

3. Ponzi & Pyramid Schemes

These classic scams have found new life in cryptocurrency, promising guaranteed returns through “revolutionary” trading algorithms or exclusive investment pools.

Investment scams with a nexus to cryptocurrency accounted for $ 5.6 billion in 2023, representing 40% of all crypto-related losses last year.

Perpetrators use early investor profits to attract more victims while secretly using new funds to pay previous investors, creating an unsustainable cycle.

Red Flags: Guaranteed high returns, referral bonuses, vague profit details, and pressure to invest fast.

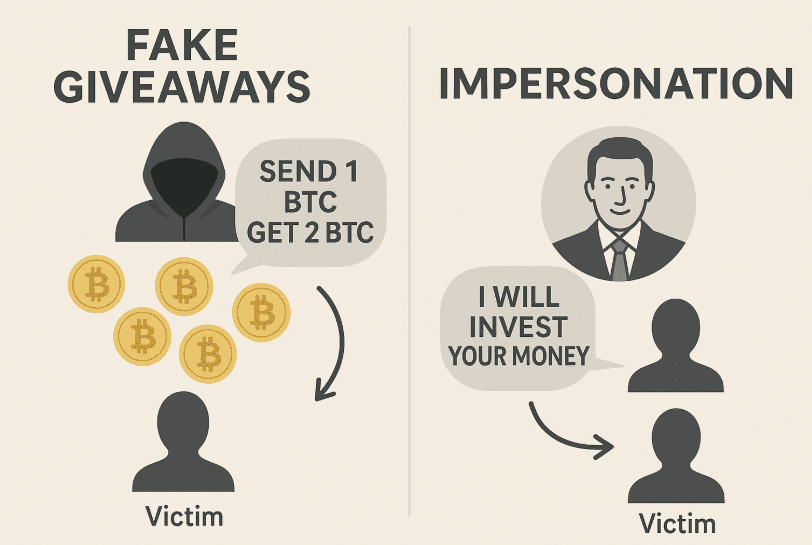

4. Fake Giveaways & Impersonation

Scammers create social media accounts impersonating crypto celebrities, promising to double any cryptocurrency sent to their address.

Some vendors are even advertising “face-changing services” for $200 worth of cryptocurrency, allowing users to create convincing deepfake videos.

Elon Musk impersonation scams are particularly prevalent, with deepfake videos showing him announcing fake cryptocurrency giveaways worth millions of dollars.

Red Flags: Celebrity accounts asking for crypto payments, “send me 1 Bitcoin, get 2 back” offers, newly created social media profiles, and verification badges on fake accounts.

No legitimate figure requests cryptocurrency payments for giveaways.

5. Investment Scams & Fake Exchanges

Fraudulent trading platforms create convincing interfaces showing fake profits to entice larger deposits.

These exchanges may allow small initial withdrawals to build trust before blocking larger amounts.

Pig butchering and other fraud schemes, addresses reported as stolen funds, and sanctioned entities represent part of this ecosystem.

Some platforms utilize AI to simulate realistic trading activity, thereby making them appear more legitimate.

Red Flags: Unregulated exchanges, exclusive trading promises, withdrawal issues, pressure to deposit more, and missing licenses.

6. Malware & Wallet Drainers

Sophisticated malware specifically targets cryptocurrency wallets, automatically transferring funds when victims connect to compromised websites.

In January 2024, a crypto drainer posed as the U.S. Securities and Exchange Commission after the regulator’s X account was compromised.

These “drainers” often masquerade as legitimate DeFi applications or NFT minting sites.

Red Flags: Unexpected wallet prompts, shady browser extensions, fake virus alerts, and sites asking for wallet permissions unnecessarily.

Always verify website URLs and avoid connecting wallets to unfamiliar sites.

7. Cloud Mining Scams

These fraudulent services promise cryptocurrency earnings through remote mining operations that don’t exist.

Scammers collect upfront fees for mining contracts while providing fabricated earnings reports.

Victims realize the fraud only when attempting to withdraw their supposed mining profits, which never existed.

Red Flags: Guaranteed daily returns, no verified mining facility, upfront payments, and unrealistically consistent or high profits.

8. NFT Scams (Fake Mints, Spoofed Marketplaces, Wash Minting)

NFT-related scams have surged as attackers create fake minting pages, impersonate popular marketplaces, or artificially inflate trading volume to appear legitimate.

In other cases, scammers run “wash minting” schemes where they trade NFTs between their own wallets to fabricate demand and raise prices artificially.

Spoofed marketplaces also remain a major threat, using cloned interfaces that steal seed phrases or initiate unauthorized transactions.

Red Flags: Unverified mint links, marketplaces with no official badges, sudden spikes in NFT trading volume, and requests for broad wallet permissions.

Always confirm mint URLs from official project pages and use a burner wallet for new mints.

9. Smart-Contract Exploits & Protocol Hacks

These attacks target vulnerabilities in DeFi protocols, where flawed code or insecure price oracles allow hackers to drain liquidity pools or manipulate token values.

High-profile incidents in 2024 and 2025 highlight how unaudited contracts and centralized admin keys remain major risk factors for users.

Even well-known protocols can be compromised if bugs go unnoticed or updates are deployed without proper testing.

Red Flags: No third-party audits, extremely high APYs, anonymous developers with full admin control, and unclear tokenomics.

Stick to audited platforms and avoid depositing large amounts into new or unverified protocols.

10. Pump-and-Dump Schemes

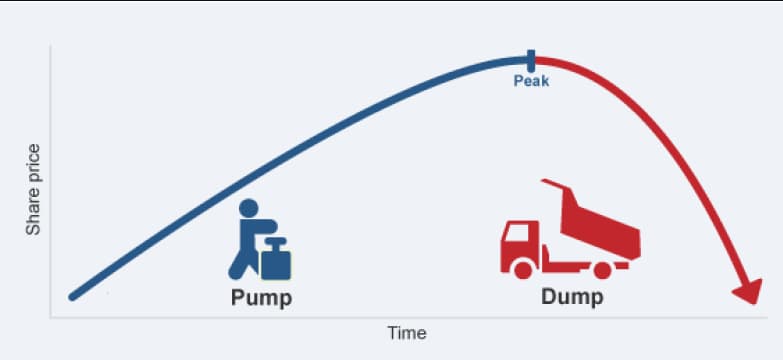

Pump-and-dump scams occur when coordinated groups artificially inflate a token’s price through hype, only to sell their holdings at the peak and leave late investors with heavy losses.

Once enough interest builds, insiders quickly dump their tokens, causing the price to collapse within minutes.

Low-liquidity tokens are especially prone to manipulation because even moderate buy orders can create misleading upward trends.

Red Flags: Extreme price spikes, concentrated token holdings, newly created social accounts pushing a project, and promises of fast profits.

Avoid tokens with thin liquidity and never invest based solely on social-media hype.

How To Identify And Avoid Crypto Scams?

Knowing how to spot and avoid crypto scams is essential to protect your investments. Here are some key tips:

- Always verify website URLs by typing them directly instead of clicking on links.

- Use hardware wallets for storing significant amounts of cryptocurrency.

- Watch out for fake sites impersonating legitimate businesses, look for spelling errors or subtle changes in domain names.

- Enable two-factor authentication on all your accounts and never share private keys or seed phrases.

- Be cautious of unsolicited messages offering investment opportunities or urgent warnings.

- Research projects thoroughly, including team backgrounds, audits, and community feedback, before investing.

- Remember, if something promises guaranteed returns or sounds too good to be true, it probably is.

What To Do If You’ve Been Scammed?

If you’ve been scammed in a crypto fraud, it’s crucial to act quickly. First, report the incident to the cybercrime portal or call the helpline 1930.

Inform your bank to stop any suspicious transactions, then secure your accounts by changing passwords and enabling two-factor authentication.

Gather all evidence and consider legal help to improve your chances of recovering lost funds.

Why Crypto Scams Are On The Rise?

Cryptocurrencies can be misused for crimes such as theft, fraud, and money laundering due to their decentralized nature, which eliminates the need for intermediaries.

The decentralized nature that makes cryptocurrency attractive also provides anonymity for criminals.

High- and low-tech fraud and scams were prevalent in 2024, with high-yield investment scams and pig butchering being the most successful types of fraud.

Additionally, the rapid pace of innovation creates regulatory gaps that criminals exploit, while dreams of massive returns make potential victims more susceptible to sophisticated psychological manipulation.

Note: Cryptocurrency isn’t legally recognized as money in India, but it serves as a digital asset convertible to INR.

Related Reads:

Conclusion: Guard Your Investments Against Rising Cryptocurrency Scams

Cryptocurrency scams keep evolving, mixing old-school tricks with new tech to create some pretty clever schemes. They don’t just target beginners; experienced investors can fall victim too.

The losses are enormous, running into billions every year, which is why it’s so important to stay informed, be cautious, and use strong security practices if you’re involved in crypto.

By learning how these scams work, taking solid security steps, and staying skeptical of offers that sound too good to be true, you can protect yourself a lot better.

In the crypto world, knowledge and caution are your best tools.

FAQS

To determine if someone is a scammer, look out for promises of guaranteed returns, urgent pressure, or requests for private information.

Yes, blockchain transactions are public, allowing experts to trace funds, but scammers often use mixers and multiple wallets to hide their tracks.

They typically start with fake websites, phishing emails, or social media impersonations that lure victims into sharing their credentials or sending funds.

Yes, the FBI actively investigates crypto-related fraud and encourages victims to report scams through their IC3 platform.