India tops the crypto adoption index. 118,968,644 Indians hold digital assets this year.

Notably, with one million BTC, it ranks second in global bitcoin adoption. User numbers rise, rules shift, and with the young, drive change.

In this article, I will explore India’s crypto adoption, demographics, and market trends shaping India’s digital finance.

Disclaimer: All the numbers mentioned in the article are subject to change over time as per the cryptocurrency data.

Crypto Adoption Statistics: A Quick Look

- India ranks #1 in the global crypto adoption index. Source: Chainanalysis

- As per the latest data, 118,968,644 people in India own cryptocurrency. Source: Coinledger

- Delhi NCR alone holds 14.6% of India’s total crypto, the largest share held by a particular region. Source: Coinswitch Q2

- Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun are amongst India’s first crypto billionaires.

What Is The Cryptocurrency Adoption Rate In India?

- India ranks #1 in the global crypto adoption index as per the latest reports

- High retail adoption is the primary driver, with a significant portion of activity coming from smaller, grassroots transactions rather than institutional investment.

- 50% of the top 10 countries in crypto adoption are from the Central & Southern Asia and Oceania (CSAO) region.

| Rank | Country | Region |

|---|---|---|

| 1 | India | Central & Southern Asia and Oceania (CSAO) |

| 2 | Nigeria | Sub-Saharan Africa |

| 3 | Indonesia | Central & Southern Asia and Oceania (CSAO) |

| 4 | United States | North America |

| 5 | Vietnam | Central & Southern Asia and Oceania (CSAO) |

| 6 | Ukraine | Eastern Europe |

| 7 | Russia | Eastern Europe |

| 8 | Philippines | Central & Southern Asia and Oceania (CSAO) |

| 9 | Pakistan | Central & Southern Asia and Oceania (CSAO) |

| 10 | Brazil | Latin America (LATAM) |

Source: Chainanalysis

- India’s current population stands at 1.45 billion.

- According to current data, India has 118,968,644 crypto owners. This makes India’s adoption % approximately 11.76%.

Source: Worldometer, Coinledger

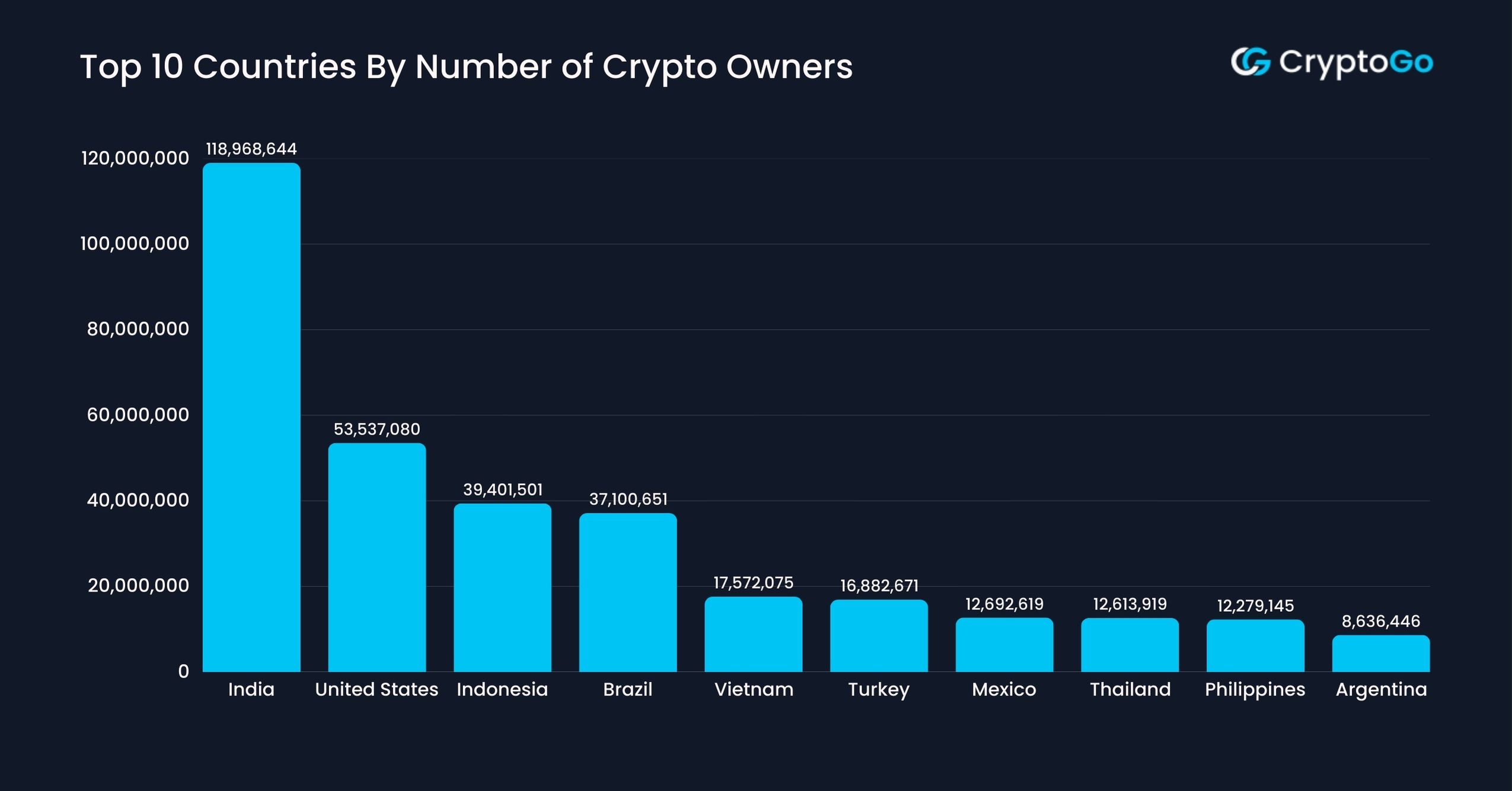

How Many People Own Crypto in India?

- According to the latest data, 118,968,644 people in India own cryptocurrency. Source: Coinledger

- CoinDCX & Coinswitch, India’s leading crypto exchange platform, have over two crore users. Source: Coinswitch Q2, CoinDCX H1 2025

- Binance has 6.28 million Indian Users. Source: Binance

- WazirX has over 16 million users on its platform. Source: WazirX

These growing users indicate a positive uptrend for cryptocurrency in India.

| Sr. No. | Country | Number of Crypto Owners |

|---|---|---|

| 1 | India | 118,968,644 |

| 2 | United States | 53,537,080 |

| 3 | Indonesia | 39,401,501 |

| 4 | Brazil | 37,100,651 |

| 5 | Vietnam | 17,572,075 |

| 6 | Turkey | 16,882,671 |

| 7 | Mexico | 12,692,619 |

| 8 | Thailand | 12,613,919 |

| 9 | Philippines | 12,279,145 |

| 10 | Argentina | 8,636,446 |

Source: Coinledger

Cryptocurrency Adoption Demographics

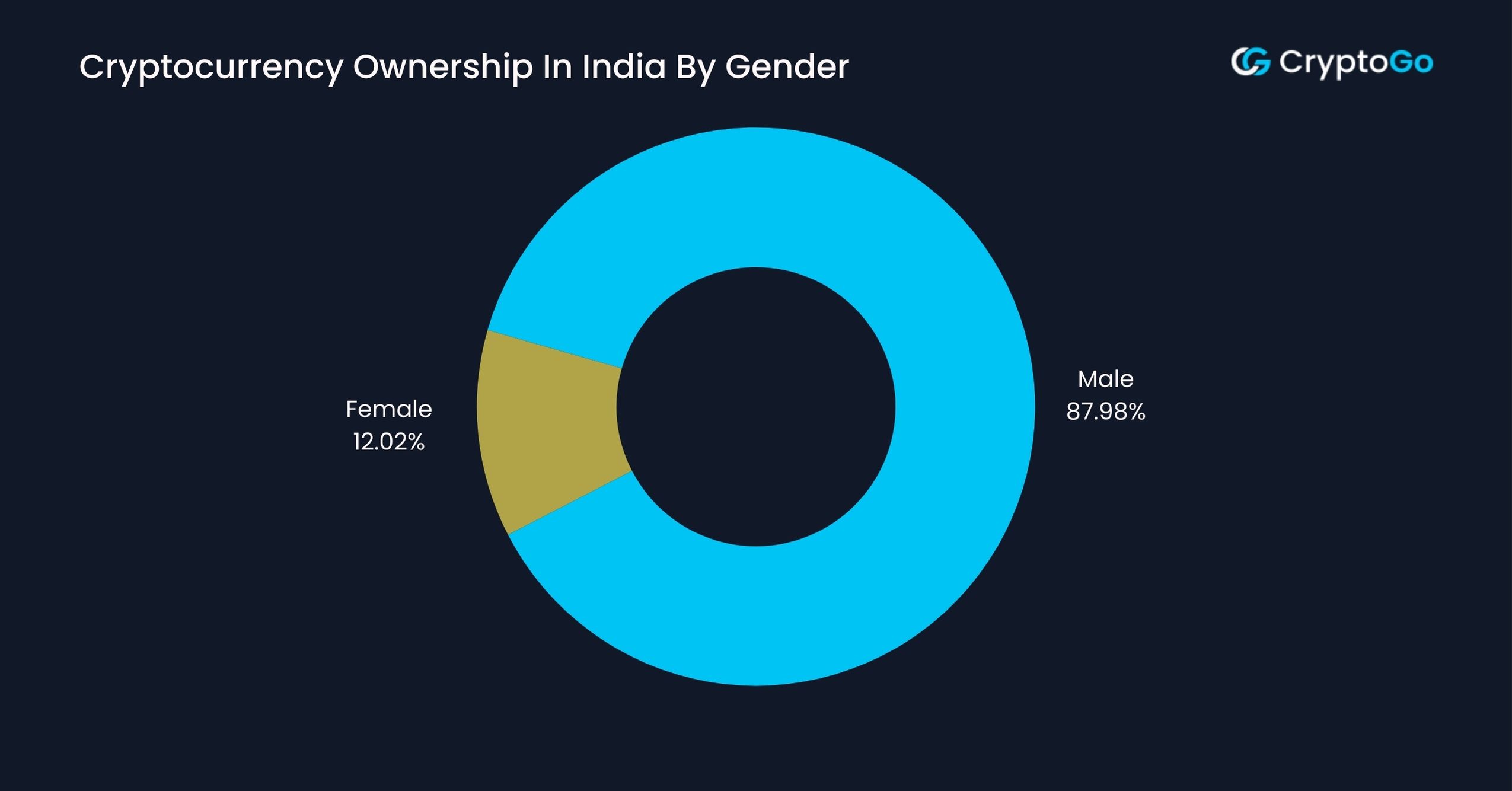

- There are 2 crore+ crypto users in India on Coinswitch, out of which 12.02% are females. Source: Coinswitch Q2

- Delhi NCR alone holds 14.6% of India’s total crypto.

Disclaimer: The figures in this section are based solely on Coinswitch’s internal data and do not represent the overall cryptocurrency market in India.

While Coinswitch’s data reflects only its user base, the data covered (Demographics) may offer a partial snapshot of broader crypto behaviour in India.

Cryptocurrency Adoption By Gender

- 87.98% of the total Indian crypto investors are male, while 12.02% are female.

- This means, for every one female crypto investor in India, there are approximately 7.32 male crypto investors.

| Sr. No. | Gender | Ownership % |

|---|---|---|

| 1 | Male | 87.98% |

| 2 | Female | 12.02% |

Source: Coinswitch Q2

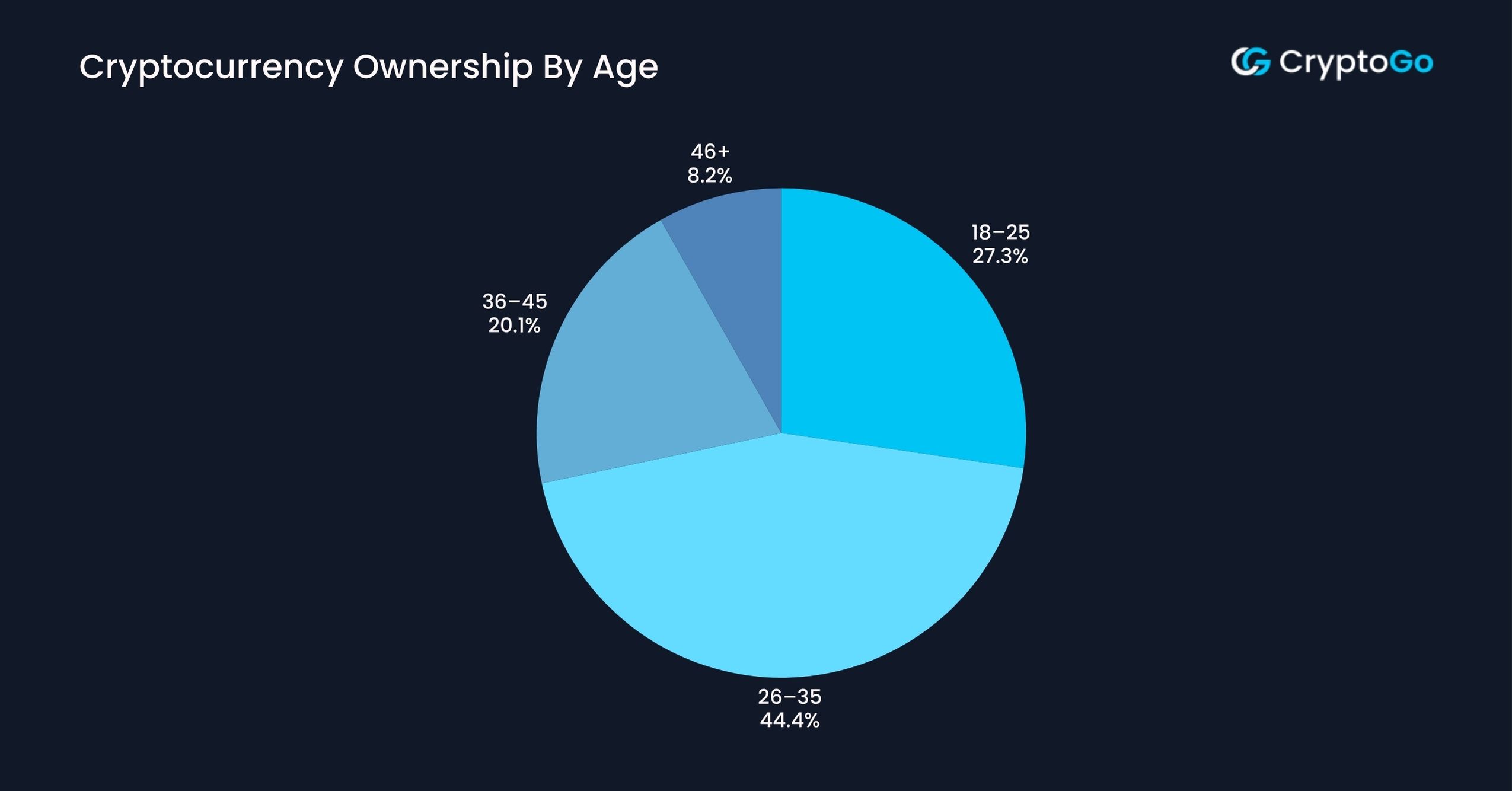

Cryptocurrency Adoption By Age

- As of current year, Indian crypto users aged between 26 and 35 are the major investors in India, with 44.4% participation.

- Over 70% of crypto investors in India are under 36, showing that most interest in crypto comes from the youth.

| Sr. No. | Age Group | Percentage |

|---|---|---|

| 1 | 18–25 | 27.3% |

| 2 | 26–35 | 44.4% |

| 3 | 36–45 | 20.1% |

| 4 | 46+ | 8.2% |

Source: Coinswitch Q2

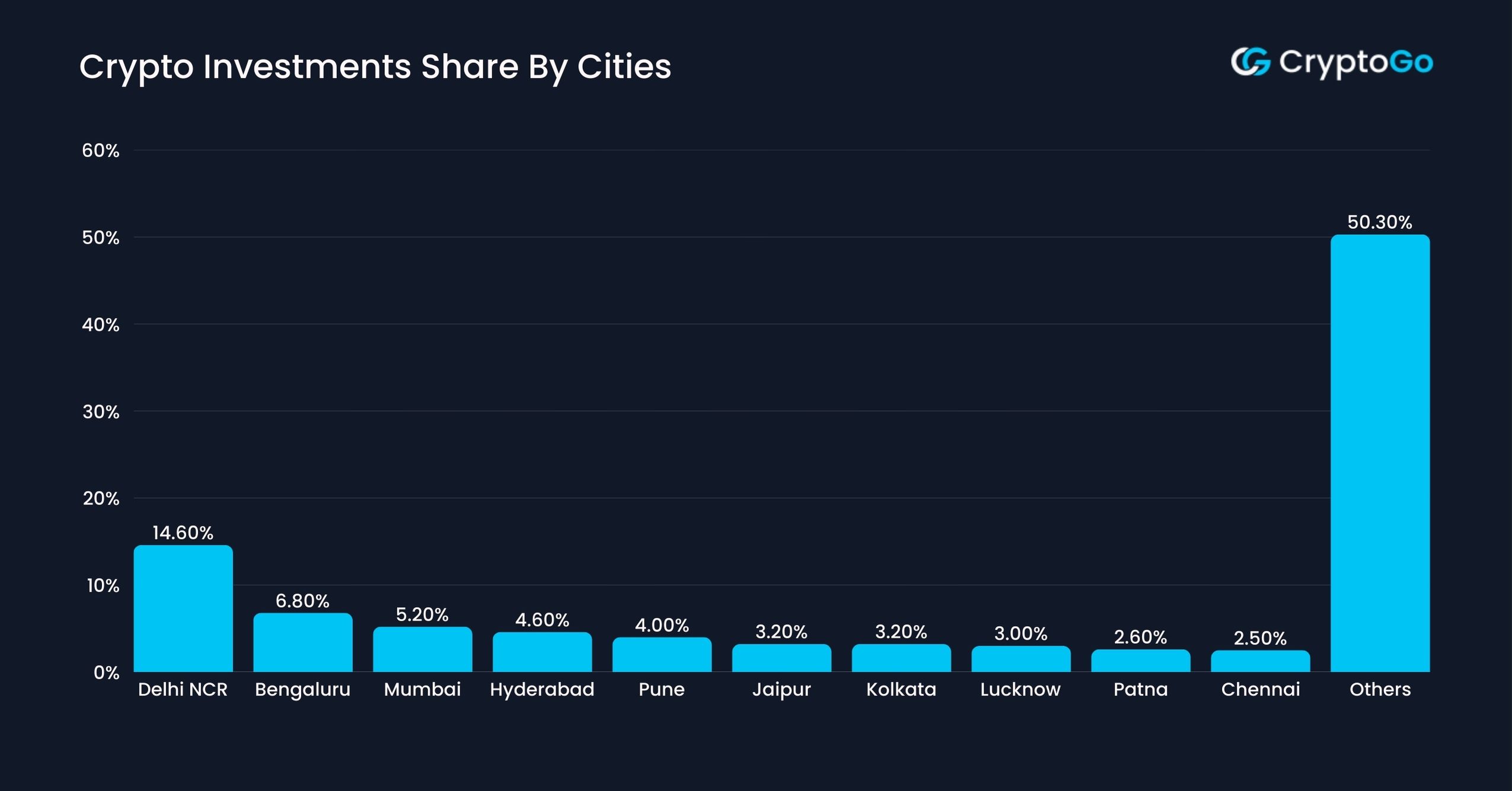

Cryptocurrency Adoption By City

- According to current stats, Delhi NCR accounts for 14.60% of India’s crypto investments.

- Among the top cities, the top 7 spots are held by metro cities.

- Mumbai, despite being India’s financial capital, ranks third and lags by 9.4 percentage points from Delhi NCR.

| Sr. No. | Cities | Holding % |

|---|---|---|

| 1 | Delhi NCR | 14.60% |

| 2 | Bengaluru | 6.80% |

| 3 | Mumbai | 5.20% |

| 4 | Hyderabad | 4.60% |

| 5 | Pune | 4.00% |

| 6 | Jaipur | 3.20% |

| 7 | Kolkata | 3.20% |

| 8 | Lucknow | 3.00% |

| 9 | Patna | 2.60% |

| 10 | Chennai | 2.50% |

| 11 | Others | 50.30% |

Source: Coinswitch Q2

Cryptocurrency Billionaires In India

- According to the latest data, Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun, Polygon’s founders, are India’s first crypto billionaires.

- Polygon’s native token, Matic, surged from a $26 million valuation in 2019 to over $14 billion by 2021, marking one of the fastest value increases among Indian-founded crypto projects.

- The platform was co-founded by Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun to address Ethereum’s high gas fees and scalability limitations.

- Each co-founder reportedly retained a 4–5% stake in the Matic token supply during its rise, significantly boosting their net worth.

- At a $14 billion token valuation, a 4.5% stake would amount to approximately $630 million per founder, pushing at least two of them into billionaire status when considering additional assets and holdings.

- Polygon’s success attracted high-profile investors, including billionaire Mark Cuban, further elevating the platform’s global recognition and valuation.

- Their achievement made them India’s first publicly known crypto billionaires, though other wealthy crypto holders may exist outside public records.

Source: Livemint

While Polygon’s founders became India’s first publicly known crypto billionaires, other key figures have also shaped the country’s digital asset market.

- Sumit Gupta, an alumnus of IIT Bombay, is the co-founder of CoinDCX, India’s first crypto unicorn and currently its most valued crypto exchange.

- When Bitcoin began gaining traction in 2014, Sumit saw the potential of blockchain technology and the positive impact it could create for India. He actualized this vision by founding CoinDCX to build the Indian crypto and Web3 industry.

- Under his leadership, the platform raised over $135 million from leading investors and now serves millions of users. His wealth grew substantially alongside CoinDCX’s expansion, establishing him as a key figure in India’s crypto ecosystem.

Cryptocurrency Adoption Index In India

- As of the current stats, Layer 1 assets (Base Blockchain Networks like Bitcoin & Ethereum) make up 35.52% of India’s total crypto holdings, making it the most dominant category.

- Meme coins (19.50%) slightly outpace DeFi tokens (14.22%) in popularity, indicating a strong speculative interest among Indian investors despite the more practical utility of DeFi.

| Sr. No. | Token | Share % |

|---|---|---|

| 1 | Layer 1 | 35.52% |

| 2 | Meme | 19.50% |

| 3 | Defi | 14.22% |

| 4 | Gaming | 6.51% |

| 5 | Layer 2 | 5.33% |

Source: Coinswitch Q2

Cryptocurrency Adoption: Where Does India Stand?

- India now leads grassroots crypto adoption, topping the latest global index. The result shows how digital money draws people across the region.

- Central & Southern Asia, but also Oceania, including India, ranks among the largest crypto markets. Between July 2023 and June 2024, the zone received more than 750 billion USD in crypto assets.

- Growth runs parallel to a shifting rulebook and tax code. India levies a 30% capital gains tax on each crypto sale and clips 1% at source from every trade.

- The heavy tax load has pushed some investors toward foreign platforms with lighter rules.

- The crypto market in India continues to grow despite the steps taken.

- The Financial Intelligence Unit pressed offshore exchanges like Binance, HTX (formerly Huobi), Kraken, Gate.io, KuCoin, Bitstamp, MEXC, Bittrex, and Bitfinex to follow the country’s anti-money-laundering rules.

- Talks with several large offshore platforms ended with their web addresses hidden from Indian users.

- One global exchange then listed itself as a reporting body, and its site reopened for Indian customers.

- Observers treat the shift as a sign that rules are settling and that the Indian crypto space is moving toward order.

- India shapes its crypto rules through steady legislative and regulatory talks.

- The move mirrors a broader shift toward tighter Anti-Money Laundering plus transparency rules, including the Financial Action Task Force “Travel Rule,” now visible in Indian FIU directives.

- Industry voices expect that sharper rules and lighter taxes will release the latent force of India’s crypto and Web3 sector.

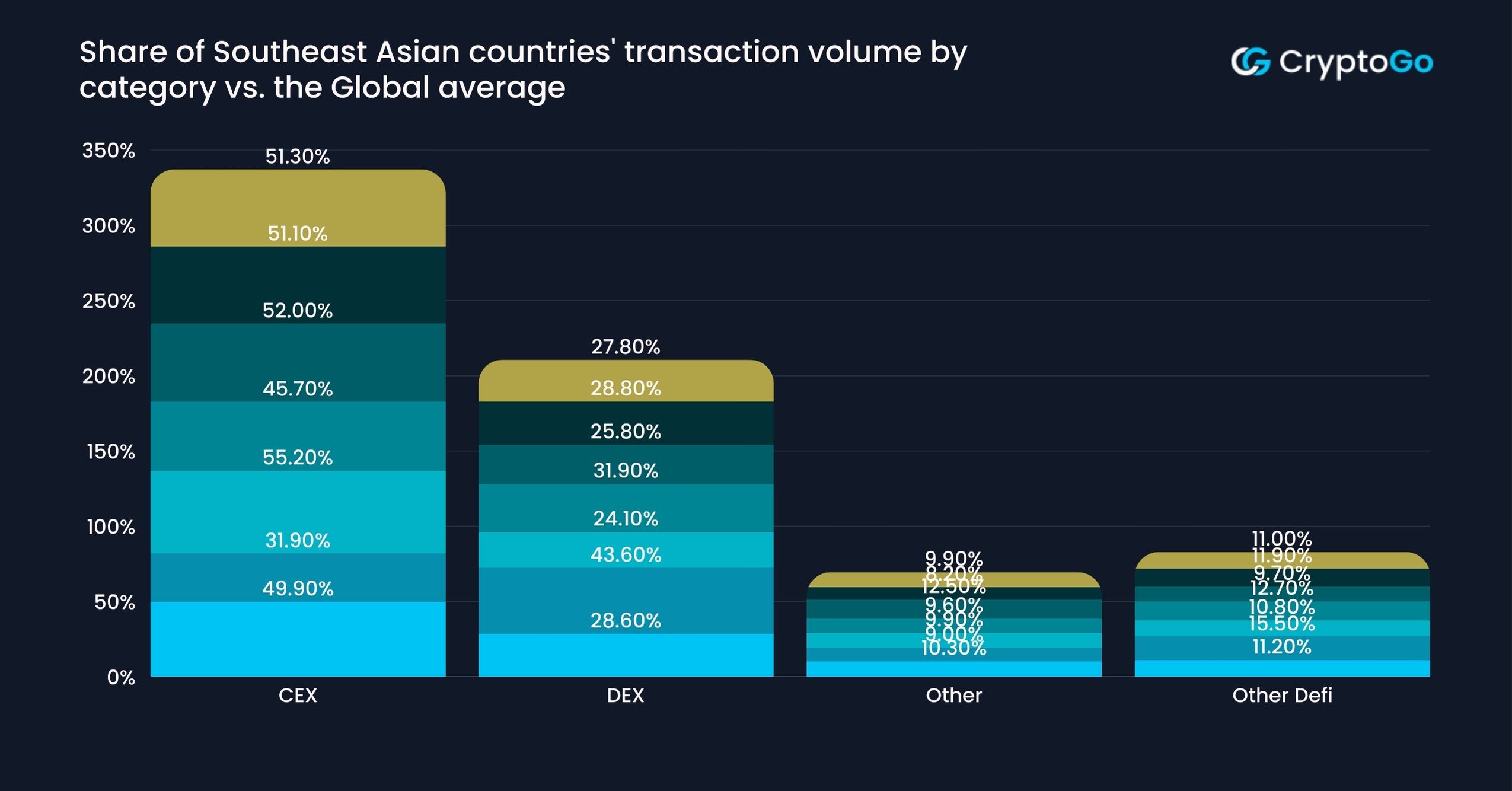

- India routes 49.9% of trade volume through centralized exchanges, slightly under the 51.3% global figure. The gap signals modestly lighter dependence on CEX than the worldwide pattern.

- Decentralized exchanges capture 28.6% of Indian flows, a hair above the 27.8% worldwide share. The difference points to marginally wider DEX uptake.

- Indonesia posts the steepest DEX share among listed nations at 43.6 %, far above the global average. The figure underlines a marked tilt toward decentralized trading.

| Sr. No. | Category | India | Indonesia | Philippines | Singapore | Thailand | Vietnam | Global |

|---|---|---|---|---|---|---|---|---|

| 1 | CEX | 49.9% | 31.9% | 55.2% | 45.7% | 52% | 51.1% | 51.3% |

| 2 | DEX | 28.6% | 43.6% | 24.1% | 31.9% | 25.8% | 28.8% | 27.8% |

| 3 | Other | 10.3% | 9% | 9.9% | 9.6% | 12.5% | 8.2% | 9.9% |

| 4 | Other Defi | 11.2% | 15.5% | 10.8% | 12.7% | 9.7% | 11.9% | 11% |

Source: Chainanalysis