Is crypto real money in India? It is a question many Indians ask today. Cryptocurrency looks like money on the screen, but it does not hold the same status as the rupee in your pocket.

In India, it is not legal tender but a digital asset that can be converted into INR through exchanges. Unlike RBI-issued notes, it has no official backing or guaranteed acceptance.

The Indian crypto market is already the largest in the world, with more than 100 million owners. Yet it still lacks regulation, RBI oversight, and the safety net that protects traditional money.

Crypto investing tempts people with high returns and global reach, but it also brings risks. A 30% tax on profits, constant price swings, and security issues show why it cannot be treated as real money. This guide explains its legal place in India and how it compares to traditional currency.

Is Crypto Real Money? (In A Glance)

Technically, crypto is not “real money” in the traditional sense. Here’s why:

| Factor | Cryptocurrency | Traditional Money (INR) |

|---|---|---|

| Issued By | Decentralized | RBI (Government) |

| Physical Form | Digital Only | Coins & Notes |

| Regulation | Unregulated in India | Regulated by the RBI |

| Insurance | Not Insured | Insured under RBI norms |

| Acceptance | Limited acceptance | Universal acceptance |

In India, crypto is considered a digital asset, not legal tender. You can trade it, invest in it, or use it on select platforms, but you can’t walk into a Kirana store and pay in Dogecoin.

What Constitutes as “Real Money” in 2026?

Before determining if cryptocurrency qualifies as “real money,” we must understand what money is. Money serves three fundamental functions, illustrated with examples relevant to India:

1. Medium Of Exchange:

Accepted for buying and selling goods and services (e.g., using rupees to pay for chai at your local tea stall or purchasing groceries at D-Mart).

2. Store Of Value:

Holds its value over time (e.g., keeping rupees in a Fixed Deposit account with SBI or storing gold jewelry for future needs).

3. Unit Of Account:

Measures the value of goods and services (e.g., pricing a Tata Nexon in lakhs or calculating a household budget).

Legal tender refers to currency officially recognized by the government for settling debts. In India, the Indian Rupee (INR) issued by the Reserve Bank of India is the only legal tender.

This means businesses and individuals must accept it to pay for goods and services by law.

The RBI has the exclusive authority to issue banknotes, which are backed by the full faith and credit of the Indian government. Any refusal to accept legal tender for settling a debt is illegal in India.

Current Crypto Status In India

In India, cryptocurrency is categorized as a digital asset rather than legal tender. While it can be traded, invested in, or utilized on select platforms, paying for goods in Dogecoin at a Kirana store is not permissible.

In India, despite the rapid adoption of cryptocurrency, it remains controversial and has regulatory uncertainties.

India’s cryptocurrency market is experiencing explosive growth, with projected revenue reaching US $6.4 billion in 2025 and an expected CAGR of 18.48% to reach US$13.9 billion by 2033.

As of the current data, the country had over 107 million cryptocurrency users, representing 7.35% of the population.

Growth is increasingly driven by smaller cities like Jaipur, Lucknow, and Pune, with many Indians viewing crypto as an alternative investment amid disappointing job growth and economic opportunities.

Can Crypto Turn Into Real Money?

You can convert cryptocurrency into INR through crypto exchanges like WazirX, CoinDCX, and Binance. After converting, the money is reflected in your Indian bank account as “real money.”

Note: Exchanges also face security risks, as seen in the CoinDCX hacked case involving ₹378 crore.

Here is how you can convert Crypto to Indian currency:

Step 1: Create an account on a registered Indian crypto exchange. Here are a few suggestions:

| Exchange | Cryptos Supported | Trading Fees | Notable Features |

|---|---|---|---|

| CoinDCX | 200+ | 0.10% (maker/taker) | QuickBuy feature, insured wallet, margin trading |

| ZebPay | 100+ | 0.15% (maker), 0.25% (taker) | Long-standing presence; low withdrawal fees |

| Kuber by CoinSwitch | 100+ | No direct trading fees | Beginner-friendly app; zero fee model (spread-based) |

| Bitbns | 400+ | 0.25% | Lending/staking options; crypto SIPs |

| Giottus | 100+ | 0.20% | Multilingual support; INR deposits/withdrawals |

| Unocoin | Limited (focus on BTC, ETH) | 0.7% (can go down with volume) | One of India’s first exchanges, SIP in BTC |

Step 2: Complete KYC verification with your Aadhaar, PAN card, and bank details

Step 3: Deposit your crypto into the exchange wallet

Step 4: Sell your crypto for INR at the current market rate

Step 5: Withdraw the INR to your linked Indian bank account

However, this process incurs taxes and transaction fees. The Indian government maintains strict taxation at 30% on crypto profits plus 1% TDS, creating a complex relationship with this emerging asset class.

Bonus: For a detailed guide on selling safely, check our post on how to sell cryptocurrency in India.

The Indian Regulatory Stance On Crypto

India’s regulatory approach to cryptocurrency has been characterized by caution and frequent policy shifts:

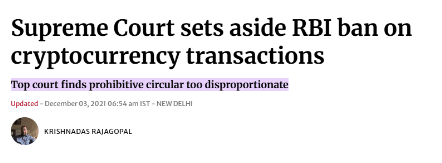

In April 2018, the Reserve Bank of India issued a circular prohibiting banks from dealing with crypto exchanges, effectively cutting off the banking system from crypto trading.

However, this ban was overturned by the Supreme Court in 2021, citing disproportionate restrictions.

Since 2019, the government has been working on cryptocurrency legislation, with draft bills alternating between proposing complete bans and regulatory frameworks. As of 2026, legislation remains pending.

In 2022, India introduced a 30% tax on crypto profits and a 1% TDS (Tax Deducted at Source) on all crypto transactions, signaling recognition of the asset class while discouraging speculative trading.

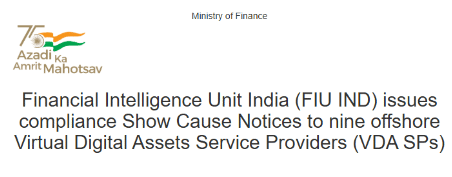

Then, in 2023, India’s government’s Financial Intelligence Unit (FIU) issued a show-cause notice to nine offshore crypto exchanges, including Binance, for operating without registering with the anti-money laundering agency.

In the same direction, some global platforms have begun adjusting to Indian rules. For instance, Bybit complies with Indian tax regulations, signaling how exchanges are adapting to survive in the market.

Many international platforms have since restricted access to Indian users.

Additionally, the RBI launched its Central Bank Digital Currency (CBDC) called the Digital Rupee in late 2022, with pilot programs for wholesale and retail segments. This move indicates the central bank prefers regulated digital currencies over decentralized alternatives.

Is Cryptocurrency Safe In India?

The safety of cryptocurrencies in India depends on multiple factors and is constantly evolving with time and every attack.

In March 2024, WazirX experienced a significant security breach affecting thousands of users’ funds, highlighting that even established platforms aren’t immune to attacks.

In response to blockchain security concerns, Reliance launched Jio Blockchain Solutions in 2023, focusing on enterprise-grade infrastructure and custody services with advanced security.

While primarily focused on business applications rather than consumer trading, this signals growing institutional interest in securing blockchain transactions in India.

To answer your question about safety, Cryptocurrency can be considered reasonably safe when you follow best practices. Safety isn’t just about the platform; it’s also about how you store, use, and protect your assets.

Cryptocurrency is Safe When:

- You use trusted platforms (e.g., CoinSwitch, WazirX)

- You enable 2FA and keep your wallet keys secure

- You stay alert to phishing scams and rug pulls

Cryptocurrency Is Risky Because:

- No insurance (unlike your savings account)

- Prone to hacks and volatility

- Lack of RBI oversight

10 Advantages of Holding Cryptocurrency

Despite the risks, crypto offers several benefits, especially for digital-savvy Indian investors:

- High Returns (but high risk)

- No Banking Barriers

- Decentralized and Transparent

- 24/7 Market Access

- Borderless Transactions

- Inflation Hedge (especially with limited supply coins like Bitcoin)

- Privacy-Oriented

- Low Transaction Fees (in many cases)

- Accessible to Everyone with a Smartphone

- Growing Adoption Globally

Crypto Risks and Challenges

Let us look at the other side of cryptocurrency:

1. Volatility:

Bitcoin’s price can drop over 50% within weeks, and smaller altcoins may lose 90% overnight. This volatility makes cryptocurrency unsuitable for essential savings or short-term funds.

For example, many Indian investors who entered in the 2021 bull market saw their portfolios decline by 70-80% in the bear market that followed.

Here’s a table summarizing the price history of Bitcoin, specifically highlighting years where there was a ~50% or more price drop:

| Year | High Price (USD) | Low Price (USD) | Approx. % Drop | Notes |

|---|---|---|---|---|

| 2011 | $31.00 (est.) | $2.00 (est.) | ~93% | Early spike and crash after gaining 2,960% from $0.09 |

| 2013 | $1,238 | $687.50 | ~44% | Large drop after first major public spike |

| 2014 | $900 (2013 Dec) | $315.21 | ~65% | Post-2013 crash — prices slumped throughout 2014 |

| 2018 | $19,345 (Dec 2017) | $3,200 (est.) | ~83% | Bear market after 2017 peak |

| 2021–2022 | $68,991 (Nov 2021) | $18,000 (Dec 2022) | ~73% | Major correction after bull run |

| 2024 | $76,999 (Nov) | Not Available | TBD | No clear drop in 2024 as per the chart |

2. Security Risks:

Once a cryptocurrency transaction is confirmed on the blockchain, it cannot be reversed. This means if you’re scammed, hacked, or send funds to the wrong address, recovery is nearly impossible.

In 2023, Indians lost an estimated ₹1,000 crore to crypto scams like rug pulls, fake exchanges, and Ponzi schemes.

3. Lack of Regulation and Investor Protection:

In early 2024, Binance restricted Indian users, hindering fund withdrawals. Unlike regulated institutions, crypto platforms often lack grievance mechanisms.

This lack of regulation limits legal recourse in disputes, resulting in uncertainty.

4. Environmental Concerns:

Bitcoin’s proof-of-work mechanism consumes significant energy. While newer cryptocurrencies like proof-of-stake are more efficient, the environmental impact of some remains a concern as India pursues its climate goals.

Why Is Cryptocurrency Controversial in India?

The Indian government has had a love-hate relationship with crypto. Although crypto isn’t banned, it isn’t regulated either. Here’s why it’s often criticized:

- No RBI Regulation: The central bank has expressed concerns about financial stability

- High Risk of Scams: Many Indians have lost money to crypto schemes

- Money Laundering Concerns: Government fears crypto enables illegal activities

- Volatile Markets: Extreme price swings affect uninformed investors

- Youth Addiction to Trading: Reports of young people gambling with life savings

Still, India has over 107 million crypto users as of 2026, showing growing interest despite risks. (Source: Statista)

Should You Invest in Cryptocurrency?

If you’re a beginner, consider the following:

- Start Small: Don’t invest money you can’t afford to lose.

- Use Indian Platforms: For easier INR transactions and tax reporting.

- Educate Yourself: Follow credible sources, not hype.

- Diversify: Don’t put all your money into one coin.

Conclusion: Crypto Remains A Digital Asset, But Not A Currency In India

Crypto is not legal tender in India, but it has become a major digital asset. With over 100 million Indian users, the market is already among the largest in the world, yet it lacks the backing and universal acceptance of the rupee.

By 2035, India’s crypto market is expected to cross $15 billion, showing its strength as an investment class. Still, its role is closer to gold or stocks than to everyday money.

If you plan on crypto investing, treat it as a high-risk asset. Use trusted exchanges, follow tax rules, and stay alert to RBI updates before making decisions.

FAQs

Yes, but it depends on market trends. Profits aren’t guaranteed.

Not widely in India. It’s better viewed as an investment asset.

It’s not illegal but unregulated. Gains are taxable.

With proposed regulations and growing adoption, crypto may play a bigger role, but it won’t replace INR anytime soon.