Crypto Arbitrage is a simple way of trading where the same crypto coin is bought on one exchange at a lower price and sold on another where the price is slightly higher. This happens because crypto prices are not always the same across platforms.

In arbitrage trading crypto, the profit per trade is small, but it can happen many times in a day. Because prices change fast, traders often use a crypto arbitrage bot or a crypto arbitrage scanner instead of manual trading.

This article explains how arbitrage in crypto works, how crypto arbitrage bots help in faster trades, and whether arbitrage trading in cryptocurrency is practical in today’s market.

What is Crypto Arbitrage: At a Glance

This practice involves a few trading methods where profit doesn’t rely on market direction, but rather on market inefficiencies.

| Aspect | Description |

|---|---|

| Definition | Buying crypto on one exchange and selling it on another for profit. |

| Why It Happens | Price gaps across exchanges are caused by latency, supply and demand, and liquidity. |

| Types of Arbitrage | Spatial, triangular, statistical, and Decentralized arbitrage. |

| Profit Potential | Usually low per trade, but scalable with speed and automation. |

| Risks | Price volatility, high fees, and slow transfers. |

| Tools & Bots | Software for automation (e.g., Pionex, CryptoHopper). |

| Worth Trying? | Viable with the right tools, timing, and experience. |

What is Crypto Arbitrage: Detailed Explanation

Crypto arbitrage is a strategy where you buy cryptocurrency at a lower price on one exchange and sell it at a higher price on another to earn a profit.

Unlike traditional trading, it doesn’t rely on predicting market trends or analyzing charts. Instead, it takes advantage of temporary price inefficiencies across exchanges.

Each exchange has its users, liquidity, and trading volume, resulting in short-lived price gaps.

For example, if Bitcoin is priced at ₹41,50,000 on Exchange A and ₹41,65,000 on Exchange B, a trader can buy low and sell high to make a ₹15,000 profit per Bitcoin.

To succeed, traders must move fast. The most profitable arbitrage today utilizes bots that scan prices in real time and execute trades within milliseconds. Manual trading usually can’t keep up.

Is Crypto Arbitrage Legal?

Crypto arbitrage is legal in most jurisdictions where cryptocurrency trading is permitted, as it simply involves buying and selling the same asset across different platforms.

However, legal status varies by country, and specific regulations may apply in each jurisdiction. Some nations restrict cryptocurrency trading entirely, making arbitrage impossible.

Others require specific licenses for professional trading activities or impose tax obligations on profits.

Traders must comply with the exchange terms of service and local financial regulations.

This includes proper tax reporting, adhering to anti-money laundering requirements, and respecting trading limits.

How to Start Crypto Arbitrage?

Starting crypto arbitrage requires setting up accounts on multiple exchanges and understanding the basic mechanics of price monitoring and trade execution.

These tips will help you to start your proper crypto Arbitrage:

- Do Your Research (DYOR)

Understand how the crypto market works, including the risks, fee structures, and how fast prices can change.

- Pick the Right Exchanges

Choose platforms with low fees, high liquidity, and fast deposit/withdrawal times to avoid delays or losses.

- Use Automation Tools

Consider using arbitrage bots or trading software to track price differences and execute trades quickly.

- Watch Out for Risks

Be mindful of network fees, slow transactions, low liquidity, or sudden price swings that could reduce or erase your profits.

- Start Small and Learn

Begin with small trades to understand the timing, process, and challenges before investing a larger amount of money.

Pro Tip: Crypto arbitrage can be profitable, but it requires speed, strategy, and often substantial capital to work effectively.

Types of Crypto Arbitrage

Crypto arbitrage comes in several forms, each targeting different market inefficiencies and requiring varying levels of technical expertise.

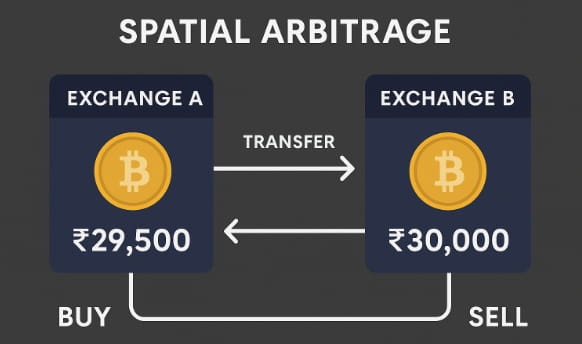

1. Spatial Arbitrage

Spatial Arbitrage Involves buying cryptocurrency on one exchange and selling it on another platform where the price is higher.

This basic form requires maintaining balances across multiple exchanges and executing trades quickly before price gaps close.

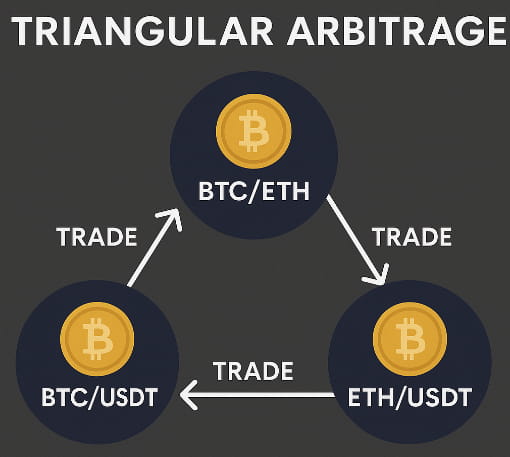

2. Triangular Arbitrage

Triangular Arbitrage exploits price differences between three cryptocurrency pairs on a single exchange.

Traders execute a series of trades through different pairs to profit from temporary price imbalances without moving funds between platforms.

3. Statistical Arbitrage

Statistical Arbitrage uses algorithmic trading based on historical data patterns and mathematical models.

Advanced traders employ sophisticated software to identify and capitalize on statistical price relationships between different cryptocurrencies or market conditions.

4. Decentralized Arbitrage

Decentralized Arbitrage targets opportunities across decentralized exchanges and DeFi protocols.

This strategy often involves flash loans and smart contracts to exploit price differences between centralized and decentralized platforms without requiring significant upfront capital.

Benefits of Crypto Arbitrage

Crypto arbitrage offers several benefits that make it attractive to both novice and experienced traders seeking consistent profit opportunities.

- Reduced Market Risk

Arbitrage avoids predicting price movements, minimizing directional risk, and making it less volatile than traditional trading.

- Consistent Profit Potential

Frequent small gains can add up over time, offering steady income regardless of overall market conditions.

- Profitability in Any Market

Whether the market is bullish or bearish, arbitrage opportunities can still exist, making the strategy market-neutral.

- Improved Market Efficiency

Arbitrage helps align prices across different exchanges, contributing to a more stable and efficient crypto market.

Risks and Challenges of Crypto Arbitrage

Crypto arbitrage faces significant challenges that can quickly turn profitable opportunities into losses if not properly managed.

- Transfer Delays

Slow blockchain confirmations can cause price gaps to close before trades settle, risking losses.

- High Transaction Fees

Network fees, especially during peak times, can wipe out small arbitrage profits.

- Slippage and Low Liquidity

Large trades or thin order books can lead to worse execution prices than expected.

- Technical and Regulatory Issues

Exchange outages, API errors, or sudden rules can block or delay trades.

- Intense Competition

Bots often act faster than humans, making it hard to secure profitable trades manually.

Top Crypto Arbitrage Tools and Platforms

Successful crypto arbitrage depends on specialized tools that automate market monitoring, analysis, and trade execution.

1. Pionex

Built for beginners, Pionex automates low-risk spot-futures arbitrage directly into its exchange with simple, user-friendly tools.

Pionex is ideal for users seeking low-risk strategies and easy setup, offering built-in spot-futures arbitrage bots with automated trading.

There is no need for the traders to have external APIs or complex configurations for crypto arbitrage.

2. Bitsgap

Advanced traders benefit from Bitsgap, which scans multiple exchanges for price differences and automates arbitrage trades alongside innovative portfolio and bot management features.

The platform supports over 15 major exchanges, enabling users to execute trades seamlessly without needing to switch interfaces.

Real-time data, backtesting tools, and demo mode help optimize strategies before risking capital.

3. CryptoHopper

Offering market and exchange arbitrage, CryptoHopper includes AI-driven automation, strategy customization, and broad exchange support for users seeking more control and precision.

It features backtesting tools to refine strategies and supports copy-trading from experienced traders for added flexibility.

4. 3Commas

With a focus on social and automated trading, 3Commas combines grid and arbitrage bots with copy-trading tools and multi-exchange integration in a clean interface.

It offers smart trading terminals, performance analytics, and a marketplace for pre-built strategies.

Is Crypto Arbitrage Still Profitable?

Crypto arbitrage will remain profitable in 2026, but success requires proper tools, sufficient capital, and realistic profit expectations.

Modern arbitrage profits are smaller than in cryptocurrency’s early days, typically ranging from 0.1% to 2% per trade, rather than the double-digit opportunities of previous years.

However, high-frequency trading and automation can scale these small margins into meaningful returns.

Success depends on minimizing costs through low-fee exchanges, fast execution via trading bots, and sufficient capital to make small percentage gains worthwhile.

Competition from institutional traders has reduced obvious opportunities, prompting profitable arbitrage to shift toward more sophisticated strategies and niche markets.

Related Read:

Conclusion: Arbitrage In Crypto Focuses On Exchange-Based Price Differences

Crypto arbitrage allows traders to profit from price differences across exchanges without predicting market direction or taking a directional risk.

Modern strategies rely on automation, technical skills, and realistic expectations, as opportunities are now smaller and more competitive than in earlier years.

Success depends on using the right tools, understanding fees and risks, and starting small while learning the intricacies of cross-exchange trading.

FAQs

Manual arbitrage is nearly impossible in 2026, as price gaps vanish in seconds. Automation is essential for reliable execution.

Bitcoin, Ethereum, and high-volume altcoins are ideal due to their liquidity and availability across multiple exchanges.

Most opportunities last only a few seconds to minutes, making speed and automation critical for success.